Gifts of Appreciated Securities

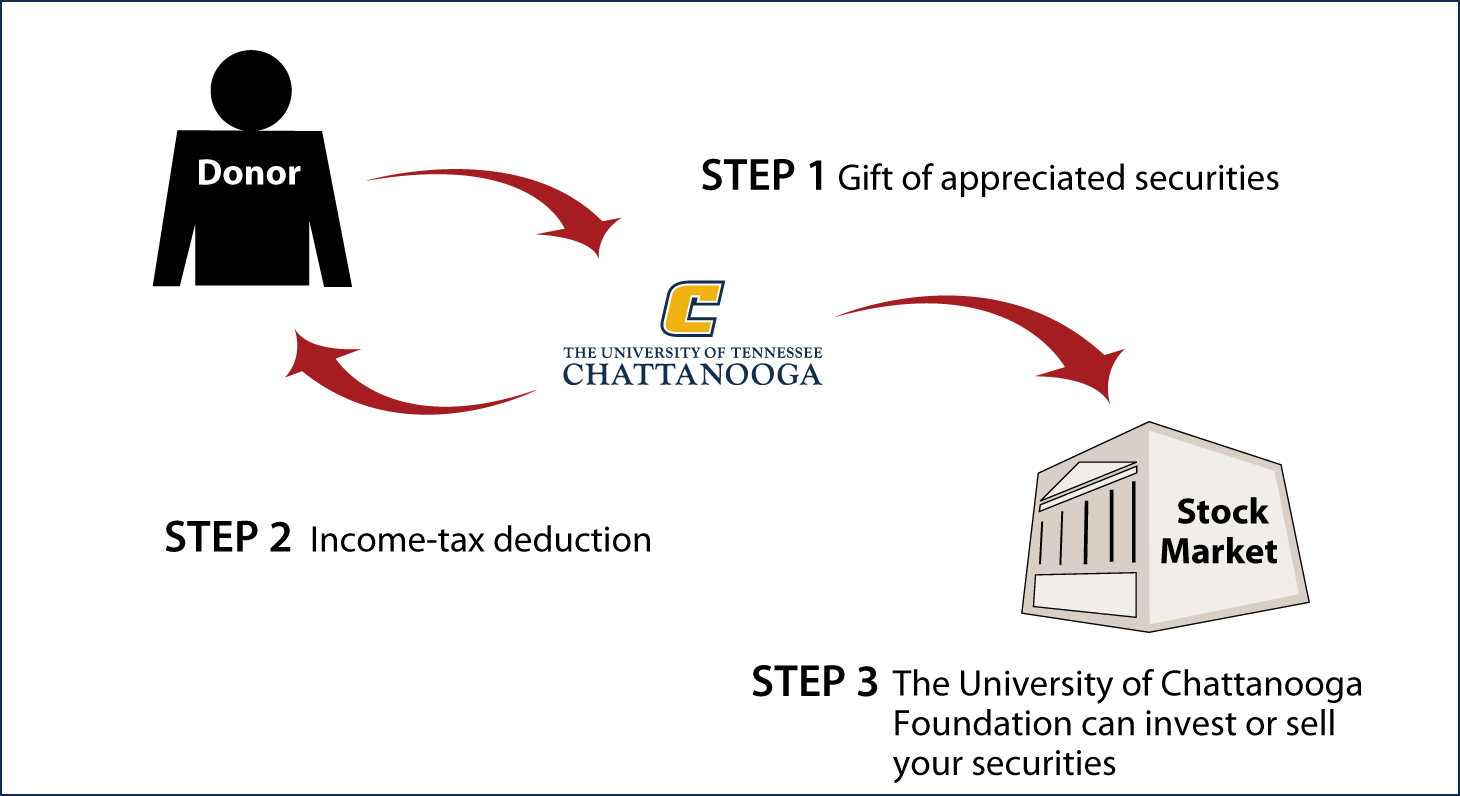

How It Works

- You can send unendorsed stock certificates by registered mail or instruct your broker to make the transfer from your account to our account

- You receive an income-tax deduction

- University of Chattanooga Foundation may keep or sell the securities

Benefits

- You may receive a federal income-tax deduction for the full fair-market value of the securities

- You avoid long-term capital-gain tax on any appreciation in the value of the stock

- Your gift will support UTC as you designate

Special note: You should call or e-mail us to tell us of your intent, and we will be able to assist you with the details of the transfer.

The University of Chattanooga Foundation exists as a repository for gifts aimed at benefiting the University of Tennessee at Chattanooga.

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

Ryan Jones |

University of Tennessee at Chattanooga |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer